It may sound corny, but I truly believe almost anyone who lives in the United States can become a millionaire. As men and women living in this county, we are afforded opportunities to work hard, educate ourselves and build something from nothing.

I did all the above and became a millionaire before I turned 40. Here are the rules I followed:

1. Invest Every Windfall

When you receive an unexpected windfall such as an inheritance, cash gift or bonus, don't spend it. Invest it. If you weren't expecting the money, you're not depriving yourself of anything by not spending it.

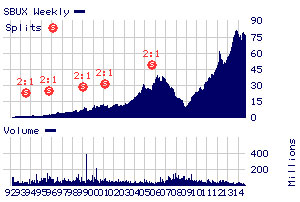

When I was 24, I received a $1,600 inheritance from my grandmother. Although I thought about buying clothes and shoes, I resisted the urge to adorn my body with depreciating assets and shopped for something far more valuable: stock in a publicly traded company. I remember the day I made my first-ever stock purchase. It was Jan. 27, 1993, and I bought 40 shares of Starbucks (SBUX) at $39¾ per share. Looking back, it was risky to put all my eggs in one basket, especially with a company that had only recently gone public and had no trading history. But as you can imagine, I got lucky.

Starbucks.com

Starbucks.comTwenty-one years and five stock splits later, those 40 shares that cost me $1,600 would now be worth almost $100,000. I sold the shares long ago because as I matured as an investor, I decided to take modest gains by occasionally selling stocks and using the proceeds to diversify my investments across of wide range of companies.

2. Live Below Your Means

You've heard that advice a million times, haven't you? You keep hearing it because it really works. You can't build wealth if you spend more than you save. In my early 20s, I lived in a small, roach-infested, studio apartment in Washington, D.C. Until I was 27, my salary never exceeded $30,000. I was paying down student loans and generally didn't have a pot to piss in. But I made do.

I figured out early on the difference between needs and wants. The one exception was an expensive gym membership. Technically it was a "want," but for me it was a "need" because had I not had a venue to work off my stress, I would have gone postal.

Do I still live in a studio apartment? No. I'm married and live with my husband and stepdaughter in a three-bedroom townhouse. But I'm still living below my means.

3. Continually Invest Small Amounts of Money

When you live below your means by not upgrading your lifestyle every time you get a raise or promotion, you have more and more money to invest. The secret to not getting whipsawed by the stock market's volatility is to invest small amounts of money at regular intervals. You do this by default when you contribute to your employer's 401(k) or 403(b) plan.

Many people have remarked to me that their 401(k) took a beating during the 2008 stock market crash but recovered fairly quickly. That's because they kept putting in the same amount every paycheck and were able to buy shares of mutual funds on sale. This approach, called dollar-cost averaging, means you'll buy more shares when prices are low and fewer shares when prices are high.

4. Contribute to Retirement Accounts

If your employer offers a retirement plan, participate in it, especially if there is a match. The match is free money, which is essentially a 100 percent return on your investment for just showing up. There are many reasons why you might choose a Roth IRA over a traditional IRA or an IRA over a 401(k). In the grand scheme of things, they're all good.

When you sock away money in a tax-deferred account, you don't have to pay Uncle Sam and his offspring, the states, every year. Your money gets to compound like a snowball for many years until you take it out for retirement. With a Roth IRA, you don't pay any taxes when you take out the money at retirement.

A guy once commented on my Facebook page that I "was not really a millionaire" because more than a third of my wealth was tied up in retirement accounts and I couldn't access it. It's fair to say that most accountants, financial advisers and DailyFinance readers would disagree with that statement, as I surely do.

5. Pay Attention to Your Investments

We've all heard the rule, "buy and hold." I don't agree with that, because it often turns into "buy and ignore." As a financial adviser, I provide complimentary portfolio reviews to prospective clients. I would run out of fingers and toes if I tried to count how many people come to me with account statements showing stocks that once traded at $60 or $70 a share and now trade at $10 or $5 or don't even trade at all.

I'm agnostic on the question of whether you should hire a financial adviser/money manager or manage your money yourself. But if you choose the latter, you need to spend the time to educate yourself (or read my book) and review your portfolio on a regular basis. When I started investing, there was barely an Internet. I spent less time on my hair and makeup in the morning and more time reading the Wall Street Journal. With the plethora of free online resources available to you today, educating yourself is easier and cheaper than ever.

The information contained herein is strictly for educational and illustrative purposes, providing commentary, analysis, opinions, and recommendations and should not be considered investment advice for any specific subscriber or portfolio or an offer to sell or a solicitation to buy any security.

No comments:

Post a Comment